Bright Savings: How to Maximize Colorado Solar Rebates

Colorado solar energy rebates offer a fantastic opportunity to reduce the costs of going solar and maximize energy savings. Whether you're looking to cut down on hefty electricity bills or contribute to a cleaner environment, understanding and utilizing these rebates can make solar power much more affordable. Here's a quick overview of the top incentives available:

- Federal Tax Credit: A 30% credit on solar installation costs.

- State Property Tax Exemption: 100% exemption from additional property tax due to solar installations.

- State Sales Tax Exemption: Complete sales tax exemption on solar system purchases.

- Local Utility Incentives: Various programs by providers like Xcel Energy and EnergySmart Colorado offer rebates and rewards for solar installations.

Transitioning to solar is more than just an environmentally conscious choice; it's a financially savvy investment, especially with the array of benefits available.

I'm Spencer Gordon, CEO and President of NextEnergy.ai. With years of dedication in providing sustainable energy solutions, I've deep-dived into the advantages of Colorado solar energy rebates. Having local roots and expertise, we're here to help you steer these opportunities and lift your property's value and sustainability. Let's explore these benefits more thoroughly in the following sections, ensuring you make the most of your solar investment journey.

Understanding Colorado Solar Energy Rebates

When it comes to going solar in Colorado, knowing about the available solar energy rebates is crucial. These rebates and incentives can significantly reduce the cost of solar installations, making it a more accessible option for many homeowners. Let's break down the key components:

Federal Tax Credit

The cornerstone of solar incentives is the Federal Tax Credit. This credit allows you to deduct 30% of your solar installation costs from your federal taxes. It's a significant saving and can be rolled over for up to five years if your tax liability is less than the credit amount. This makes it one of the most attractive incentives for those considering solar.

State Incentives

Colorado sweetens the deal with its own state-level incentives:

- Property Tax Exemption: Installing solar panels can increase your home's value, but Colorado exempts you from paying extra property taxes on that increased value. This exemption can save homeowners an average of $177 annually.

- Sales Tax Exemption: When purchasing a solar system, you won't have to pay the state's 2.9% sales tax on the equipment. This upfront saving can make a big difference in the total cost of your solar project.

Local Rebates

In addition to federal and state incentives, local utility companies offer various rebates and rewards.

- Xcel Energy Solar*Rewards: For customers meeting certain income requirements, Xcel Energy provides upfront incentives for each watt of solar installed. This can substantially lower the initial investment needed for solar panels.

- EnergySmart Colorado and Holy Cross Energy: These programs offer upfront rebates to customers who install solar, further reducing costs.

With these incentives, going solar in Colorado is not just a smart environmental choice—it's a financially sound investment. By taking advantage of these rebates, you can significantly lower the upfront costs and enjoy long-term savings on your energy bills.

Key Benefits of Going Solar in Colorado

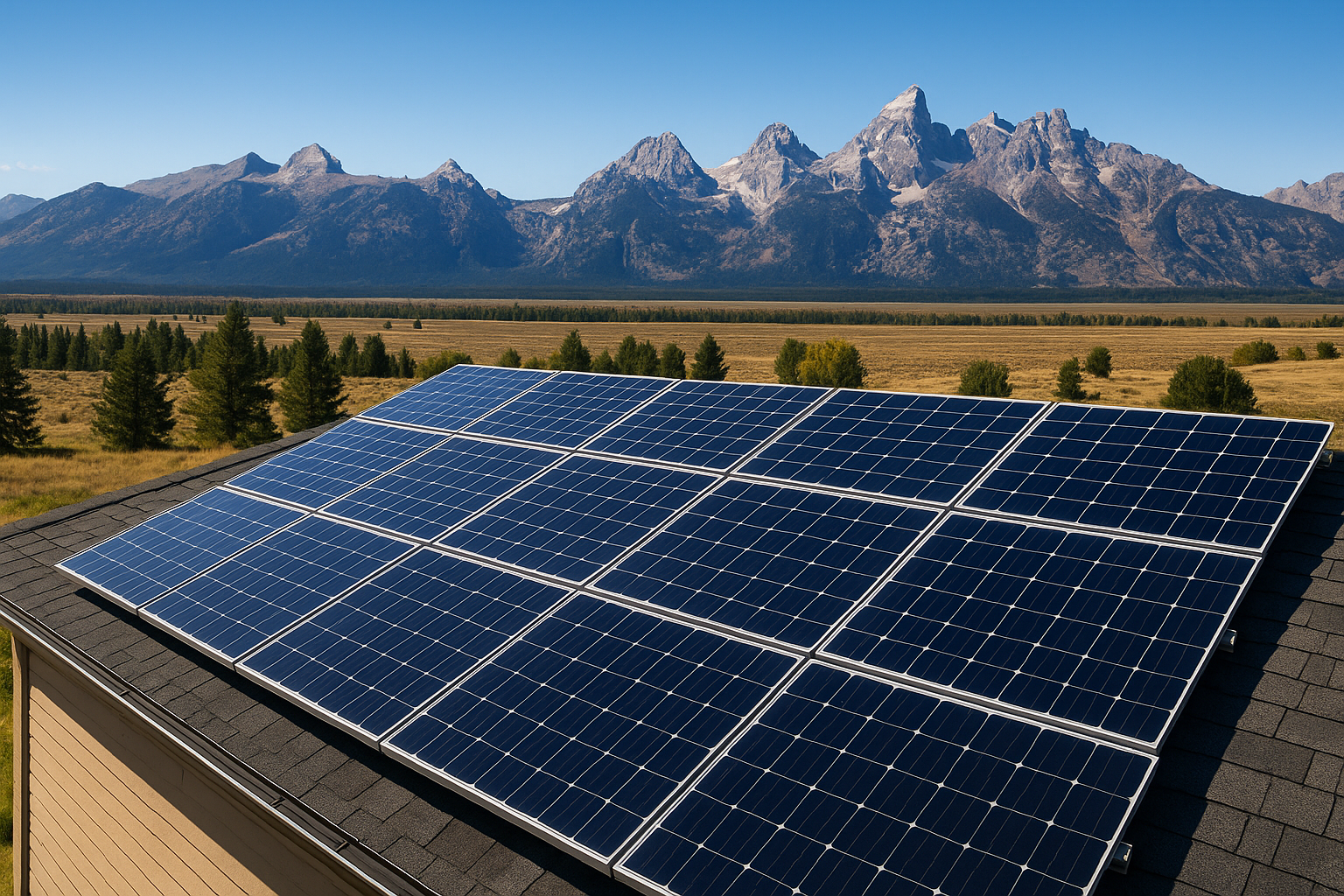

Making the switch to solar energy in Colorado isn't just about saving money. It's also about gaining independence from traditional energy sources and doing your part to reduce carbon emissions. Let's explore these key benefits:

Electricity Cost Reduction

One of the most appealing aspects of going solar is the potential for significant savings on your electricity bills. By generating your own power, you can reduce or even eliminate your reliance on the grid, which means lower monthly energy costs. With the 30% federal tax credit and other state incentives, the initial investment in solar becomes even more affordable, leading to quicker returns through reduced energy bills.

Carbon Emissions Reduction

Solar energy is a clean, renewable power source that helps reduce your carbon footprint. By installing solar panels, you contribute to Colorado's goal of achieving 100% clean energy generation by 2050. A recent study highlighted that Colorado has tripled its renewable energy generation since 2010, now accounting for 30% of the state's electricity. This shift not only helps protect the environment but also positions Colorado as a leader in sustainability and climate action.

Energy Independence

With solar energy, you gain greater control over your energy needs. This independence means you're less affected by fluctuations in energy prices and potential outages. Colorado's abundant sunshine makes it an ideal state for solar power, allowing homeowners to harness natural resources and reduce dependency on fossil fuels. Plus, with programs like Xcel Energy Solar*Rewards, you can earn incentives for the solar energy you produce, further enhancing your energy autonomy.

By choosing solar in Colorado, you're not just making a wise investment—you're taking a proactive step towards a sustainable and independent energy future.

How to Qualify for Colorado Solar Rebates

Qualifying for Colorado solar energy rebates is a straightforward process but requires understanding specific eligibility criteria and application steps. Here's a simple guide to help you steer through it:

Eligibility Criteria

To qualify for solar rebates in Colorado, you typically need to be a homeowner and a taxpayer in the state. This ensures you can benefit from incentives like property tax exemptions and sales tax exemptions. Additionally, being a customer of certain energy providers, such as Xcel Energy, can open up further rebate opportunities like the Solar*Rewards program.

For programs like Colorado Solar for All, which is still in development, eligibility will be income-based. This program aims to make solar more accessible to low-income residents, with specific criteria to be determined.

Application Process

Applying for solar rebates involves several steps:

- Federal Tax Credit: When you install a solar panel system, you can claim a 30% federal tax credit. To apply, simply file IRS Form 5695 with your federal tax return. This credit can be rolled over for up to five years if your tax liability is less than the credit amount.

- Property Tax Exemption: Colorado offers a 100% exemption on any additional property taxes from the increased home value due to solar installation. Check with your local county assessor's office for any forms or documentation needed.

- Sales Tax Exemption: To benefit from the sales tax exemption on solar equipment, you need to fill out a specific form at the time of purchase. This exempts you from the state's 2.9% sales tax on solar systems.

- Local Rebates: Some local utilities, like Holy Cross Energy, offer additional rebates. Contact your local utility provider to learn about available programs and the application process.

Income Qualifications

For income-qualified programs like the upcoming Colorado Solar for All, being below a certain income threshold will be necessary. These programs are designed to ensure that solar energy is accessible to everyone, regardless of income level. Keep an eye on announcements from the Colorado Energy Office for detailed income eligibility requirements as these programs are rolled out.

By understanding these criteria and processes, you can maximize your savings and take full advantage of the solar rebates and incentives available in Colorado.

Top Solar Incentives Available in Colorado

Colorado is a fantastic place to go solar, thanks to a variety of incentives that make it more affordable. Let's explore the top solar incentives available:

Inflation Reduction Act

The Inflation Reduction Act has provided a significant boost to solar energy initiatives across the United States. For Colorado residents, this means more opportunities to tap into federal funding that supports solar projects. This act aims to accelerate the adoption of renewable energy and offers financial incentives that can cover a substantial portion of solar installation costs.

Property Tax Exemption

One of the standout benefits in Colorado is the property tax exemption for solar systems. When you install solar panels, your home's value typically increases. Normally, this would mean higher property taxes, but Colorado offers a 100% exemption on any additional property tax due to the increased home value from solar installations. This can save homeowners an average of $177 annually, making it a smart financial move.

Sales Tax Exemption

Another attractive incentive is the sales tax exemption. Colorado exempts the 2.9% state sales tax on the purchase of solar equipment. This exemption reduces the overall cost of going solar, making it more accessible for homeowners. For instance, if you purchase a solar system costing $10,000, you save $290 right off the bat.

Xcel Energy Solar*Rewards

If you're an Xcel Energy customer, you're in luck. The Xcel Energy Solar*Rewards program provides upfront incentives for every watt of solar power installed. This program is income-based, so check the eligibility criteria to see if you qualify. It's an excellent way to reduce the initial cost of solar installation and start saving on energy bills sooner.

By taking advantage of these incentives, Colorado residents can significantly lower the cost of solar installation and enjoy the long-term benefits of clean, renewable energy. Whether it's through federal acts, tax exemptions, or utility programs, there are plenty of ways to make solar energy work for you in Colorado.

Frequently Asked Questions about Colorado Solar Energy Rebates

Does Colorado have a rebate for solar?

Yes, Colorado offers several rebates and incentives for solar installations. These include local rebates from programs like Xcel Energy's Solar*Rewards, which provides upfront incentives for every watt of solar power you install. Additionally, federal incentives such as the Residential Clean Energy Credit can significantly reduce your installation costs. This credit allows you to claim 30% of your solar panel system installation cost on your federal taxes, helping you save money while going green.

What is the 30% federal tax credit for solar?

The 30% federal tax credit, also known as the Residential Clean Energy Credit, is a major federal incentive for those installing solar panels. It allows you to deduct 30% of the cost of your solar installation from your federal income taxes. For instance, if your solar installation costs $10,000, you can reduce your tax liability by $3,000. This credit can be rolled over to the next year if you don't use it all at once, making solar power more affordable and accessible.

Is solar power worth it in Colorado?

Absolutely! Colorado's sunny climate and various incentives make solar power a smart investment. The state's average electricity cost is relatively high, so switching to solar can lead to significant savings on your energy bills. Plus, with incentives like the federal tax credit and state exemptions, your return on investment can be substantial. Not only do you save money, but you also contribute to reducing carbon emissions, making solar power a win-win for both your wallet and the environment.

Conclusion

At Next Energy.AI, we're passionate about helping you harness the power of solar energy with our AI-improved solar solutions. Our systems don't just collect sunlight; they intelligently manage your energy usage to maximize efficiency and savings.

Colorado is a fantastic place to go solar, thanks to its sunny climate and generous incentives. With Colorado solar energy rebates and the 30% federal tax credit, the financial benefits are significant. Our AI-improved technology ensures you get the most out of these incentives, optimizing your energy usage and reducing your electricity costs.

Choosing solar with us means you're investing in a sustainable future. Our solutions are designed to provide energy independence and environmental benefits, making your transition to solar as seamless as possible. We're committed to delivering cutting-edge technology that adapts to your lifestyle, ensuring you get the most value from your investment.

Ready to take control of your energy future? Explore our Highlands Ranch location to learn more about how Next Energy.AI can help you make the most of Colorado's solar opportunities. Join us in creating a brighter, more sustainable tomorrow.