Maximize Your Savings: Solar Panel Tax Incentives in Wyoming

Open uping Solar Savings in Wyoming: A Guide to Tax Incentives

Tax incentives for solar panels in Wyoming represent a significant opportunity for homeowners looking to reduce both their energy costs and carbon footprint. While Wyoming may rank 49th nationally for installed solar capacity, the combination of abundant sunshine (averaging 5.53 peak sun hours daily) and available financial incentives makes solar an increasingly attractive investment for residents across the state.

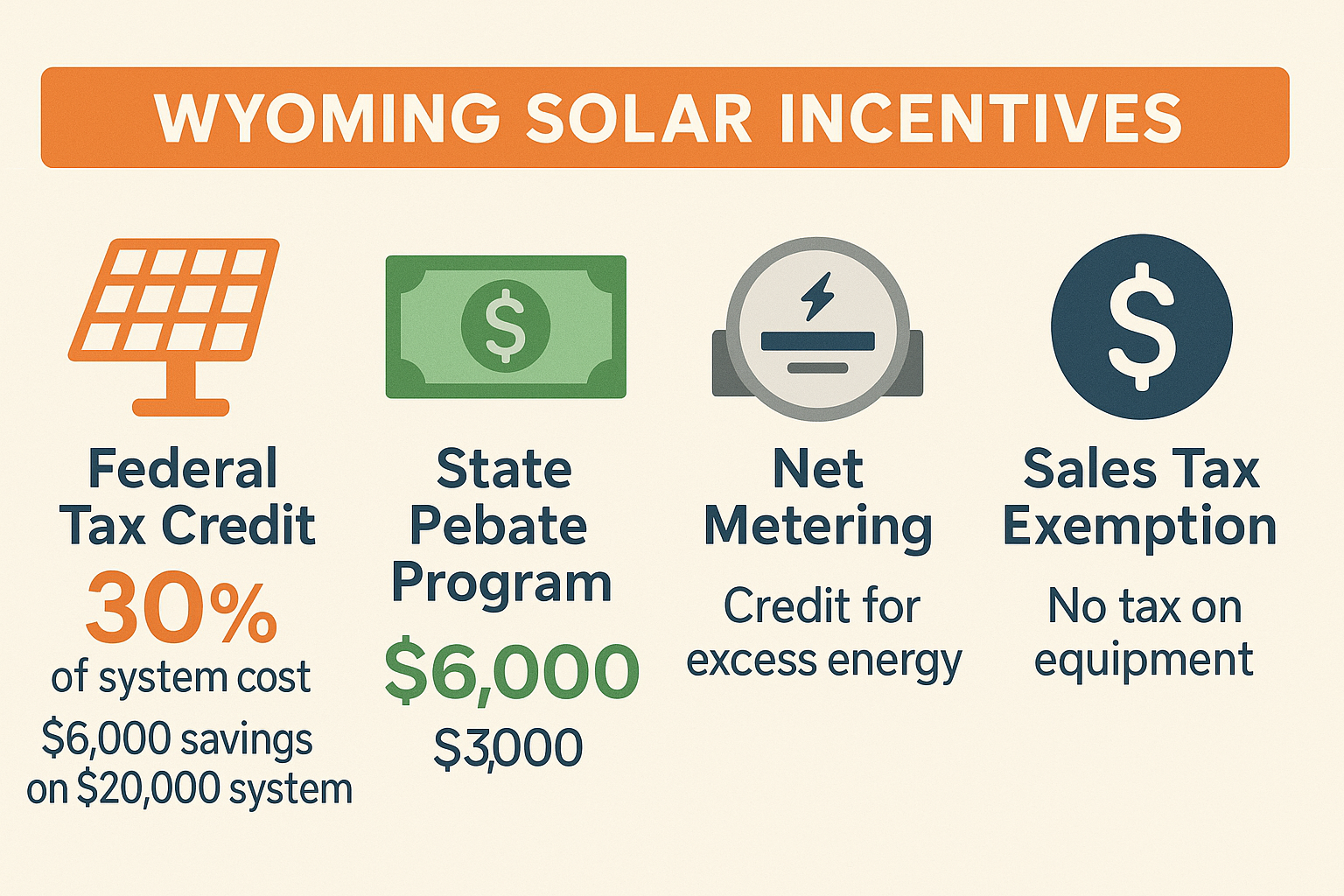

The federal government offers the most substantial incentive through the Residential Clean Energy Credit (formerly known as the Investment Tax Credit), which allows homeowners to deduct 30% of their solar installation costs from their federal taxes. This credit remains at 30% through 2032 as part of the Inflation Reduction Act, providing long-term stability for solar investments.

Despite limited state-specific incentives, Wyoming does offer a valuable residential rebate program that can cover up to 50% of installation costs (capped at $3,000) along with a sales tax exemption on solar equipment purchases. When combined with robust net metering policies that credit homeowners for excess energy production, these incentives can significantly accelerate the payback period for solar installations.

I'm Spencer Gordon, CEO of NextEnergy.ai, and I've helped hundreds of Wyoming homeowners steer the complex landscape of tax incentives for solar panels in Wyoming while serving as a renewable energy consultant with my NAPCEP certification in photovoltaics.

Federal Tax Incentives for Solar Panels in Wyoming

When it comes to making solar affordable in the Cowboy State, federal incentives do the heavy lifting. If you've been considering going solar, these incentives might just tip the scales in your favor.

The star of the show is the Federal Solar Investment Tax Credit (ITC), now officially called the Residential Clean Energy Credit. This program has been changing the solar landscape since 2006, making renewable energy accessible to everyday homeowners across Wyoming.

Here's the good news: this tax credit currently gives you back a whopping 30% of your total solar investment through a dollar-for-dollar reduction on your federal taxes. Imagine installing a $20,000 solar system on your Wyoming home—you'd get $6,000 back at tax time!

And unlike some incentives, there's no upper limit on this credit. Whether you're installing a modest system or covering your entire ranch with panels, that 30% applies to every penny you spend.

"Solar energy tax credits reduce the upfront costs of solar installation and help homeowners save money on their electricity bills in the long run."

What makes this even better is how comprehensive the credit is. It covers not just the panels themselves, but also inverters, mounting equipment, installation labor, permitting fees, sales tax, and even battery storage systems (as long as they're charged primarily by your solar panels).

Thanks to the Inflation Reduction Act passed in 2022, this generous 30% credit is locked in through 2032, giving Wyoming homeowners plenty of time to plan their solar journey. After that, it will step down to 26% in 2033 and 22% in 2034 before expiring for residential installations in 2035.

To qualify for this tax incentive for solar panels in Wyoming, you need to:

- Own your solar system outright (leased systems don't qualify)

- Install it on your primary or secondary residence in the U.S.

- Have the system up and running during the tax year you're claiming the credit

For many Wyoming families, this federal incentive is the foundation that makes solar financially viable, often cutting years off the payback period. When you combine it with state programs and net metering (which we'll cover soon), solar starts making a lot of financial sense—even in a state known for its fossil fuel production.

How to Claim the Federal Solar Tax Incentives in Wyoming

Claiming your solar tax credit isn't complicated, but it does require some attention to detail. Let me walk you through the process to make sure you get every dollar you deserve.

First, check your tax situation. Since this is a non-refundable credit, you'll need sufficient tax liability to claim the full amount. If your tax bill is smaller than your credit, don't worry—you can carry forward any unused portion to future tax years (currently through 2036).

Before tax season arrives, gather all your paperwork. You'll need your final contract showing the system cost, proof of payment, manufacturer specs, installation completion documents, and the permission to operate from your utility company. Keeping these organized from the start will save you headaches later.

When it's time to file, you'll complete IRS Form 5695 (Residential Energy Credits). This form walks you through calculating your 30% credit, which you'll then transfer to your Form 1040. Most tax software has specific sections for renewable energy credits that make this process even simpler.

One Wyoming solar customer shared: "I was bracing for a complicated process, but it was surprisingly straightforward. My tax software practically did the work for me. The hardest part was just making sure I had all my receipts in one place."

After filing, keep all your documentation for at least seven years in case the IRS has questions. And if you're not completely comfortable handling this yourself, it's worth consulting with a tax professional who understands renewable energy incentives.

Here's an interesting tip: if you installed solar in 2022, you may have initially expected the then-current 26% credit. However, the Inflation Reduction Act retroactively boosted this to 30%. If you've already filed with the lower percentage, you might be able to file an amended return to claim the additional credit—that's free money you don't want to leave on the table!

For Wyoming farmers and ranchers considering solar for agricultural operations, the federal tax incentives for solar panels in Wyoming apply to your installation too, though with slightly different rules for business applications. Plus, you might qualify for additional USDA programs that we'll explore later in this guide.

With these federal incentives as your foundation, you're well on your way to making solar an affordable reality for your Wyoming home. Next, let's look at what the state of Wyoming itself offers to sweeten the deal even further.

Wyoming State Tax Incentives for Solar Panels

While Wyoming might not be the first state that comes to mind for solar incentives, there are some valuable state-level programs that can make your solar journey more affordable. These local incentives, when combined with federal benefits, can significantly reduce your overall investment.

The Wyoming State Rebate Program is perhaps the most exciting state incentive for homeowners. This program offers a generous 50% rebate on your residential solar installation costs, up to a maximum of $3,000. Unlike tax credits that you have to wait to claim when filing taxes, this rebate provides direct financial assistance toward your upfront costs. That's real money back in your pocket shortly after installation!

"I was shocked when I received my rebate check," says Jackson resident Tom Miller. "Getting $3,000 back just a few weeks after my installation really made the whole project more affordable than I initially thought possible."

Wyoming also offers a Sales Tax Exemption for solar power equipment purchases. With the state sales tax rate at 4% (plus any additional local taxes), this exemption translates to substantial savings. For example, if you're installing a typical $20,000 residential system, you could save around $800 in state sales tax alone. That's money that never leaves your wallet in the first place!

It's worth noting that Wyoming's position as the nation's leading coal producer has historically influenced its renewable energy policies. However, the state's abundant sunshine (averaging 5.53 peak sun hours daily) makes it naturally well-suited for solar energy production. As more Wyoming residents recognize the economic benefits of solar power, we may see additional state incentives develop in the future.

For the most current information on available incentives, we recommend checking the Database of State Incentives for Renewables & Efficiency (DSIRE), which maintains comprehensive and regularly updated information on solar incentives across all states.

While Wyoming doesn't currently offer a state-specific solar energy tax credit similar to the federal ITC, and lacks a property tax exemption for the added home value from solar installations, the existing incentives still provide meaningful savings. The combination of the rebate program and sales tax exemption, along with the federal tax credit, creates a compelling financial case for going solar in Wyoming.

Eligibility for Tax Incentives for Solar Panels in Wyoming

Not everyone qualifies for every solar incentive in Wyoming, so understanding the eligibility requirements is crucial before you start your solar project. Let's break down who can benefit from these programs and how to successfully apply.

For the federal Solar Tax Credit, you'll qualify if:

- You own your solar panel system (leased systems don't qualify)

- The system is installed on your primary or secondary residence in Wyoming

- Your system is new or being used for the first time

- The installation is completed and operational within the tax year you're claiming the credit

The Wyoming state rebate program has its own set of requirements:

- You must be the homeowner of the property where the system is installed

- Your installation must be completed by a qualified contractor

- The system must meet specific technical and safety standards

- You'll need to provide detailed documentation of costs and system specifications

Applying for Wyoming's residential rebate program isn't complicated, but it does require attention to detail. You'll typically need to:

- Complete an application form (available through the Wyoming Business Council)

- Submit documentation of your installation costs

- Provide proof that your system meets required standards

- Include photographs of your completed installation

- Submit utility interconnection approval documents

"The paperwork seemed daunting at first," shares Cheyenne resident Sarah Johnson, "but my installer guided me through each step. The rebate approval took about six weeks, and that $3,000 check made a huge difference in my overall investment."

Be mindful of important deadlines! For the federal tax credit, you must claim it for the tax year in which your system became operational. For Wyoming's rebate program, applications typically must be submitted within 90-180 days after installation completion. The sales tax exemption is applied at the time of purchase, so make sure your solar provider knows to apply it.

Many of these incentive programs have limited funding and operate on a first-come, first-served basis. We strongly recommend starting your application process as soon as your installation is complete to maximize your chances of receiving all available benefits.

Wyoming farmers, ranchers, and small business owners should know that additional eligibility criteria may apply for programs like the USDA's Rural Energy for America Program (REAP), which we'll discuss in a later section.

Working with a solar provider experienced in Wyoming installations, like Next Energy.AI, can make the whole process much easier. Our team stays current on all available programs and can guide you through each step of the application process, ensuring you don't leave any money on the table.

Net Metering Programs in Wyoming

Net metering is like having a savings account for electricity – and it's one of the most valuable ongoing benefits for solar panel owners in Wyoming. This program effectively turns your home into a small power plant that can sell excess electricity back to the grid, dramatically improving the financial return on your solar investment.

Wyoming law requires all electric utilities in the state to offer net metering to customers with renewable energy systems up to 25 kilowatts in capacity. While this includes solar, wind, and hydropower systems, solar panels are by far the most common choice for homes across the Cowboy State.

The beauty of net metering lies in its simplicity. When your solar panels produce more electricity than your home is using (which often happens during sunny Wyoming afternoons), the excess electricity flows back to the grid, and your utility meter actually runs backward. Your utility company then credits your account for this excess generation, typically at the full retail rate. These credits offset electricity you pull from the grid when your panels aren't producing enough – like at night or during cloudy days.

"Net metering makes it so you will owe very little, or even nothing, on your electric bill with solar panels."

Wyoming's net metering policy includes several homeowner-friendly features that make it particularly valuable:

- Credits for excess generation roll over month to month

- Any unused credits at the end of the annual billing cycle (typically December 31) are purchased by the utility at the "avoided cost" rate

- No additional standby charges or capacity fees for solar customers

- The utility must provide a bidirectional meter at no additional cost to you

It's worth noting that net metering policies can vary slightly between different utility companies across Wyoming. The major utilities include Rocky Mountain Power (serving much of southern and eastern Wyoming), Black Hills Energy (northeastern Wyoming), Cheyenne Light, Fuel & Power (Cheyenne area), and various rural electric cooperatives throughout the state.

While all these utilities must offer net metering, the specific implementation might differ in how excess credits are calculated and when they expire. Some cooperatives, for example, might use an "avoided cost" rate for crediting excess generation rather than the full retail rate.

A Laramie homeowner with a 5kW solar system recently shared her experience: "With net metering, my annual electricity costs dropped from over $1,200 to just $180. During summer months, I actually receive credits on my bill that carry me through much of the winter. It's like having a savings account of electricity."

For Wyoming residents considering solar, the combination of net metering with tax incentives for solar panels in Wyoming creates a compelling financial case. While the upfront tax credits and rebates reduce your initial investment, net metering provides ongoing financial benefits that continue for the 25-30 year lifespan of your system.

You can learn more about whether solar makes financial sense for your specific situation in our article: Are Solar Panels Worth It in Wyoming?

Enrolling in Net Metering to Maximize Savings

Getting enrolled in net metering is a crucial step for Wyoming solar panel owners who want to maximize their long-term savings. While the process involves several steps, the payoff in ongoing utility bill savings makes it well worth the effort.

Before your solar panels can start earning you credits, you'll need to complete the interconnection process with your utility company. This typically begins with submitting an interconnection application that includes your system specifications, site plan, electrical diagram, and equipment details. Your utility will review this application (usually taking 2-4 weeks) to ensure your system meets their technical requirements.

Once approved, your solar installer can proceed with the installation, making sure everything complies with the National Electrical Code and local building requirements. After installation, your system will need to pass local building inspections and possibly a utility inspection.

The next step is the installation of a bidirectional meter by your utility company. This special meter tracks both the electricity you draw from the grid and the excess electricity your system sends back. You'll then sign an interconnection agreement with your utility that outlines the terms of your participation in the net metering program. Finally, your utility will grant permission to operate, allowing your system to be turned on and begin producing electricity – and savings!

A Cheyenne resident who recently completed this process shared: "The paperwork seemed daunting at first, but my installer handled most of it. The most important thing was staying in regular communication with both the installer and the utility company to keep things moving forward."

When enrolling in net metering, proper system sizing is crucial. In Wyoming, net metering provides the most financial benefit when your system produces close to 100% of your annual electricity usage. Oversizing can be less advantageous since excess annual credits are typically purchased at a lower rate than what you pay for electricity.

Timing your application can also impact your savings. The best time to apply is before your solar installation begins, but the optimal time of year to maximize net metering benefits is typically in spring. This allows your system to build up credits during Wyoming's sunny summer months that can then be used during the darker winter period.

Once you're enrolled, it's important to regularly monitor your electric bills to ensure you're receiving proper credits for your excess generation. Most modern solar systems include monitoring apps that make this easy to track.

It's also worth noting that while Wyoming currently has favorable net metering laws, these policies can change. Staying informed about any proposed changes is important for long-term planning.

For many Wyoming homeowners wondering if solar is worth the investment, net metering is often the factor that tips the scales toward profitability. While tax incentives for solar panels in Wyoming reduce your initial investment, net metering provides the ongoing financial returns that typically result in payback periods of 10-15 years, with free electricity for many years afterward.

At Next Energy.AI, our AI-improved monitoring systems can help you optimize your energy production and consumption patterns to maximize your net metering benefits, providing insights into when to use electricity and when to export it for the greatest financial advantage.

Additional Federal Programs and Grants

Wyoming homeowners and businesses looking to go solar have access to several powerful federal programs beyond just the standard tax credit. These additional funding sources can make solar significantly more affordable, especially for those in rural areas.

The USDA Rural Energy for America Program (REAP) stands out as a particularly valuable opportunity for Wyoming's agricultural producers and rural small businesses. This program offers substantial financial support through:

Grants covering up to 25% of your project costs, loan guarantees for up to 75% of costs, or even combined funding covering up to 75% of your total investment. The flexibility of REAP is impressive - grants range from modest $2,500 amounts all the way up to $500,000 for larger projects, while loan guarantees can reach an impressive $25 million.

"REAP has been a game-changer for many of our agricultural clients," shares a renewable energy consultant working in Wyoming. "For example, a cattle ranch near Laramie was able to offset nearly all of their electricity costs with a solar array that received 25% funding through REAP, in addition to the 30% federal tax credit."

To qualify for these generous tax incentives for solar panels in Wyoming through REAP, you need to be either an agricultural producer (with at least 50% of your gross income coming from agricultural operations) or a small business located in a rural area (generally anywhere outside cities with populations over 50,000). Given Wyoming's rural character, many residents and businesses naturally qualify.

The application process involves conducting an energy assessment, developing your project proposal, completing USDA forms, and providing technical and financial information. While this might sound complicated, solar installers experienced with Wyoming installations can guide you through this process.

Beyond REAP, Wyoming residents can access several other federal financing options:

Energy-Efficient Mortgages (EEMs) let you roll the cost of solar into your home mortgage - a smart way to finance solar at mortgage interest rates. Clean Renewable Energy Bonds and Qualified Energy Conservation Bonds primarily benefit public entities but can support community solar projects that benefit individual homeowners.

For Wyoming households with limited incomes, programs like the Low-Income Home Energy Assistance Program (LIHEAP) and the Weatherization Assistance Program (WAP) sometimes include solar as part of comprehensive energy improvements. These programs can make solar accessible to families who might otherwise find it financially out of reach.

In communities like Cheyenne, the combination of these federal programs with local and state incentives can sometimes result in free or heavily subsidized solar installations. If you're wondering whether you might qualify for free solar panels in Cheyenne, it's worth consulting with a local installer familiar with all available programs.

Wyoming businesses enjoy additional benefits through the Modified Accelerated Cost Recovery System (MACRS), which allows for rapid depreciation of solar investments over just five years. This tax advantage significantly improves the financial returns for commercial installations, often cutting payback periods in half compared to residential systems.

When you combine these additional federal programs with the standard 30% tax credit, Wyoming's state rebate program, and net metering benefits, the financial case for solar becomes remarkably strong - even in a state traditionally associated with fossil fuel production. At Next Energy.AI, we help our Wyoming clients steer this complex landscape of incentives to maximize their savings.

The Impact of the Inflation Reduction Act on Solar Incentives

When President Biden signed the Inflation Reduction Act (IRA) into law in August 2022, it changed the game completely for Wyoming homeowners considering solar. As someone who's helped hundreds of Wyoming families go solar, I've seen how this landmark legislation has transformed the financial equation.

The most immediate win for Wyoming residents is the boost to the federal solar tax credit. Before the IRA, this credit was on a declining path – scheduled to drop from 26% to 22% in 2023 before disappearing entirely for homeowners in 2024. The IRA completely reversed course:

The credit jumped back up to a generous 30% for installations from 2022 through 2032. For a typical $20,000 Wyoming solar installation, this means $6,000 back in your pocket instead of $5,200 – an extra $800 in savings without doing anything different!

Even better, the IRA made this increase retroactive to the beginning of 2022. I've had the pleasure of calling several clients who installed earlier in the year to share the good news that they'd be getting more money back than expected.

"I was shocked when my installer called to tell me I'd be getting an additional $800 back on my taxes," shared Rachel, a homeowner from Casper who installed her system in March 2022. "It felt like finding money I didn't know I had."

The stability this legislation provides is perhaps its greatest gift. With the 30% credit now guaranteed through 2032 (before stepping down to 26% in 2033 and 22% in 2034), Wyoming homeowners can plan their solar investments with confidence.

As we approach 2026, we're already seeing the long-term benefits of this legislation for Wyoming residents, which go well beyond just extending the tax credit. The act expanded eligibility in several important ways:

Battery storage systems now qualify for the 30% credit, even as standalone installations. This is huge for Wyoming homeowners, where winter storms can knock out power. Now you can add battery backup to an existing solar system and still claim the credit.

Non-profits and public entities like churches, schools, and local governments can now benefit directly through a "direct pay" option. Before the IRA, these tax-exempt organizations couldn't use tax credits. Now, places like the Campbell County School District can install solar and receive the equivalent of the tax credit as a direct payment.

Rural energy programs received a massive funding boost, with an additional $1.72 billion for the USDA's Rural Energy for America Program (REAP). For Wyoming's farmers and ranchers, this means more grant money available to help fund renewable energy projects.

The IRA also established additional incentives for low and moderate-income households in Wyoming, including rebates for energy efficiency improvements that can work hand-in-hand with solar to reduce overall energy needs.

When combined with Wyoming's state-specific incentives like the residential rebate program and sales tax exemption, the improved federal incentives create an incredibly compelling case for going solar in Wyoming.

"The IRA has been a complete game-changer for our Wyoming clients," notes a solar consultant in Cheyenne. "Many folks who were on the fence before are now moving forward because the math simply makes too much sense to ignore."

For more detailed information about how the IRA might affect your specific situation, you can read more about the IRA bill here or reach out to our team at Next Energy.AI for a personalized assessment of your potential savings under these new incentives.

The bottom line? There's never been a better time for Wyoming homeowners to invest in solar, thanks to the unprecedented tax incentives for solar panels in Wyoming made possible by the Inflation Reduction Act.

Maximizing Your Savings: Steps for Wyoming Homeowners

When it comes to getting the most out of tax incentives for solar panels in Wyoming, a little planning goes a long way. I've helped hundreds of Wyoming families steer this process, and I've found that taking a strategic approach not only maximizes your savings but also ensures a smoother installation experience.

Timing Your Solar Installation

The when matters almost as much as the how when installing solar in Wyoming.

Summer and early fall are ideal for installations in our state - between June and September, we typically enjoy clear skies and milder weather, making installation work more efficient and safer. This timing also gives you a head start on generating power before winter arrives.

If you're planning to claim the federal tax credit for a specific year, make sure your system is fully operational (not just purchased) before December 31st. The permitting process in cities like Cheyenne and Laramie can take anywhere from 2-6 weeks, so build this into your timeline.

One of our Laramie customers, Mike, shared his experience: "I started the process in July, which gave plenty of time for permitting and installation before winter. By December, my system was up and running, allowing me to claim the tax credit for that year while also building up net metering credits during the sunny fall days."

Properly Size Your System

Right-sizing your solar system is crucial for maximizing your return on investment.

Start by analyzing a full year of your electricity bills to understand your consumption patterns. Wyoming homes typically need a 5-8kW system to offset most of their electricity usage, but this varies based on your energy habits and home efficiency.

Consider future needs too - if you're planning to purchase an electric vehicle or add to your home, you might want to size your system accordingly. For optimal returns with Wyoming's net metering policies, aim for a system that produces 100-110% of your annual electricity usage.

Choose Quality Components

While it might be tempting to cut costs on equipment, quality components often provide better long-term returns and perform better in Wyoming's challenging climate.

High-efficiency panels may cost more initially but generate more electricity over time, especially important during our shorter winter days. Durable mounting systems are essential for handling Wyoming's notorious winds (we've all experienced those 50+ mph gusts!). And smart inverters help optimize production and provide valuable monitoring data.

At Next Energy.AI, we've found that premium components typically add about 10-15% to the initial system cost but can increase lifetime production by 15-25%, resulting in better economics over the 25+ year lifespan of your system.

Bundle Incentives Effectively

Don't leave money on the table! Make sure you're taking advantage of every available incentive:

Apply for both the 30% federal tax credit and Wyoming's residential rebate program (up to $3,000). Confirm that your installer doesn't charge sales tax on your equipment - this exemption is automatic, but sometimes gets overlooked. Check with your local utility for any additional rebates they might offer.

If you're a rural resident or agricultural producer, you might also qualify for USDA's Rural Energy for America Program (REAP) grants, which can be combined with other incentives for even greater savings.

Work with Experienced Local Installers

Choosing the right installation partner is perhaps the most important decision you'll make in your solar journey. Look for companies with specific Wyoming experience who understand our unique building codes, utility requirements, and climate challenges.

Your installer should help you steer all available incentives and provide the documentation needed for claims. They should also offer robust after-installation support, assisting with utility interconnection and monitoring system performance.

As a Wyoming-focused installer, we at Next Energy.AI have developed relationships with local permitting offices and utilities throughout the state, which helps streamline the process for our customers.

Document Everything

The paperwork might not be exciting, but it's essential for claiming your incentives. Save all receipts and contracts related to your solar purchase. Take photos documenting your installation process and completed system. Keep copies of all utility correspondence regarding interconnection and net metering.

For tax purposes, maintain copies of your tax forms showing claimed credits for at least seven years. This documentation isn't just for incentives – it's also valuable for warranty claims and when selling your home.

Leverage AI for Ongoing Optimization

After installation, technology can help maximize your return on investment. Modern monitoring systems allow you to track production and ensure optimal performance. Understanding when you're using electricity helps you maximize self-consumption during peak production hours.

At Next Energy.AI, our intelligent monitoring systems can help identify potential issues before they impact production and suggest optimization opportunities throughout your system's lifetime. This ongoing optimization is especially valuable in Wyoming, where seasonal variations in production are significant.

By following these steps, Wyoming homeowners can typically reduce their solar installation costs by 40-50% through various tax incentives for solar panels in Wyoming while ensuring their system performs optimally for decades to come. The journey to energy independence might seem complex, but with the right approach and partners, it's well within reach for most Wyoming families.

Frequently Asked Questions about Tax Incentives for Solar Panels in Wyoming

Do I qualify for the 30% federal solar tax credit in Wyoming?

If you're considering solar in Wyoming, you'll be happy to know that most homeowners qualify for the full 30% federal solar tax credit. This incentive (officially called the Residential Clean Energy Credit) is available if you meet a few straightforward requirements.

First, you need to own your solar system outright—leased systems don't qualify. The panels must be installed on either your primary home or a vacation property in Wyoming. Timing matters too—the system needs to be installed in 2022 or later to qualify for the full 30% rate, which remains available through 2032.

You'll also need sufficient tax liability to take advantage of the credit, though don't worry if your tax bill is smaller than the credit amount. Any unused portion can be carried forward to future tax years, giving you plenty of time to capture the full benefit.

What makes this credit particularly valuable is that it applies to your entire solar investment—equipment, labor costs, permitting fees, and even sales tax are all included. For a typical $20,000 Wyoming solar installation, you're looking at a substantial $6,000 reduction in your federal taxes.

A Cheyenne homeowner I spoke with recently shared her experience: "I was worried about qualifying since my tax liability wasn't very high. My accountant explained that I could carry forward the unused portion of the credit to future years, which made it work perfectly for my situation."

For business property installations, you'll claim the Commercial Clean Energy Credit instead. It also provides a 30% benefit but comes with slightly different rules and paperwork requirements.

How does the Wyoming state rebate program work?

Wyoming's residential solar rebate program offers a generous 50% rebate on installation costs, up to a maximum of $3,000. This direct cash benefit significantly reduces your out-of-pocket expenses for going solar.

The process is straightforward but does require some paperwork after your system is up and running. Once installation is complete, you'll submit an application to the Wyoming Business Council or relevant state agency. Your submission needs to include proof of installation, a detailed breakdown of costs, technical specifications of your system, photos showing the completed installation, and documentation showing your utility has approved the interconnection.

After the state verifies that your system meets all requirements, you'll receive a rebate check for 50% of your costs, up to the $3,000 cap. For example, if your installation costs $10,000, you'd receive a $3,000 rebate (the maximum, since 50% would actually be $5,000). For a smaller $5,000 system, you'd get $2,500 back (the full 50%).

One of our customers in Buffalo shared: "The rebate process took about 8 weeks from submission to receiving the check. The paperwork was straightforward, and my installer helped gather all the required documentation."

That funding for this program may be limited, so it's wise to apply promptly after your installation is complete. Program requirements can also change from year to year, so verify the current guidelines before you begin your solar project.

Are there utility company incentives for solar installations in Wyoming?

Yes! Several Wyoming utilities offer additional incentives that can make your solar investment even more attractive. These benefits vary depending on which company provides your electricity.

If you're in southern or eastern Wyoming served by Rocky Mountain Power, you can take advantage of their Blue Sky program that provides support for renewable energy projects. They also offer clear net metering policies that allow monthly credit rollovers, and occasionally introduce special pilot programs with additional incentives.

For those in northeastern Wyoming with Black Hills Energy, you'll find retail-rate credits through their net metering program, energy efficiency rebates that complement solar installations, and streamlined interconnection processes that make going solar easier.

Cheyenne Light, Fuel & Power customers enjoy net metering with credits at retail rates, access to dedicated renewable energy staff who can assist with interconnection questions, and may find periodic solar incentives through their efficiency programs.

If you're served by one of Wyoming's Rural Electric Cooperatives, policies will vary. Some offer more favorable net metering terms than required by state law, and many provide technical assistance for members interested in solar. It's worth checking with your specific cooperative about their solar-friendly programs.

A solar consultant who regularly works with Wyoming clients explained to me: "The utility incentives in Wyoming aren't as rich as in some neighboring states, but the net metering policies are generally favorable. The key is understanding your specific utility's policies before designing your system."

Utility programs change frequently, so I always recommend contacting your provider directly or working with a knowledgeable local installer like us at Next Energy.AI. Our team stays current on all available programs and works regularly with every major Wyoming utility. We can help you steer their specific requirements and maximize the incentives available to you.

For those living in areas with municipal utilities, you might find additional local incentives not offered by larger providers—including simplified permitting, reduced connection fees, or even direct rebates in some communities.

Conclusion

Wyoming's journey toward solar adoption presents a unique opportunity for homeowners looking to reduce their energy costs while contributing to a more sustainable future. While the state may not lead the nation in solar installations, the combination of tax incentives for solar panels in Wyoming creates a compelling financial case for going solar.

The 30% federal tax credit, Wyoming's residential rebate program offering up to $3,000, sales tax exemptions, and robust net metering policies collectively can reduce the cost of going solar by 40-50%. For a typical Wyoming home, this translates to a payback period of 10-15 years, followed by decades of nearly free electricity.

As we've explored throughout this guide, maximizing these incentives requires careful planning and attention to detail. Working with experienced local installers who understand Wyoming's specific climate challenges and incentive landscape is crucial for success.

The passage of the Inflation Reduction Act has provided long-term certainty for solar incentives, extending the 30% federal tax credit through 2032. This stability gives Wyoming homeowners confidence that 2025 is an excellent time to invest in solar energy.

At Next Energy.AI, we're committed to helping Wyoming residents steer the solar incentive landscape. Our AI-improved solar solutions not only help you capture available incentives but also optimize your system's performance throughout its lifespan. By integrating advanced monitoring and energy management systems, we transform standard solar installations into intelligent energy systems that maximize both environmental and financial benefits.

Whether you're in Cheyenne, Laramie, or any of the communities we serve across Wyoming and Northern Colorado, our team is ready to help you assess your solar potential and develop a customized solution that leverages every available incentive.

The future of energy in Wyoming is bright, and solar power will play an increasingly important role as more residents recognize its benefits. By acting now, you can be at the forefront of this transition while securing the most favorable incentives currently available.

For personalized guidance on solar incentives and installation in your specific Wyoming location, contact our team at Next Energy.AI. We'll help you steer the complexities of going solar and ensure you maximize every available incentive to reduce your upfront costs and accelerate your return on investment.

The sun shines bright in Wyoming—with the right approach, you can turn those abundant rays into substantial savings for decades to come.